Understanding Nigeria’s Banking Sector Recapitalisation

Banking Sector Recapitalisation Update | April 2024

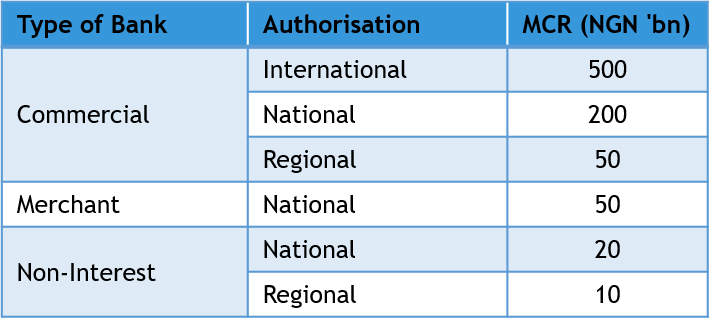

As anticipated, the Central Bank of Nigeria (CBN) has implemented a significant hike in minimum capital requirements (MCR) for Nigerian banks. This significant revision, coming nearly two decades after the initial one in 2004, signals the CBN’s intent to strengthen the financial system’s resilience. Banks are granted a 24-month window (April 1, 2024 – March 31, 2026) to comply, but the focus on Tier 1 capital, specifically share capital and share premium, suggests a stricter approach. By prioritizing fresh capital injections, the CBN aims to bolster banks’ core equity buffers. This not only enhances their capacity to absorb potential losses but also creates a foundation for future growth, potentially fueling expansion within the Nigerian banking sector.

Prior to the 2004 reforms, Nigeria’s banking sector was riddled with vulnerabilities. A plethora of undercapitalized banks choked the system, hindering their ability to support large businesses and investments. Furthermore, dominance by small banks with limited reach and poor regulatory oversight led to a toxic mix of weak corporate governance, inaccurate reporting, and a surge of non-performing loans, particularly those benefiting insiders. These historical challenges necessitate the current capital requirement increase. By strengthening banks’ capital base and promoting stricter regulations, the CBN aims to prevent a relapse into this era of financial instability and foster a more robust banking system for the future.

Nigeria’s push for a trillion-dollar economy by 2030 hinges on a robust financial system, which necessitates the need for recapitalization within the banking sector. This is expected to improve banks’ capacity to lend and foster business growth.

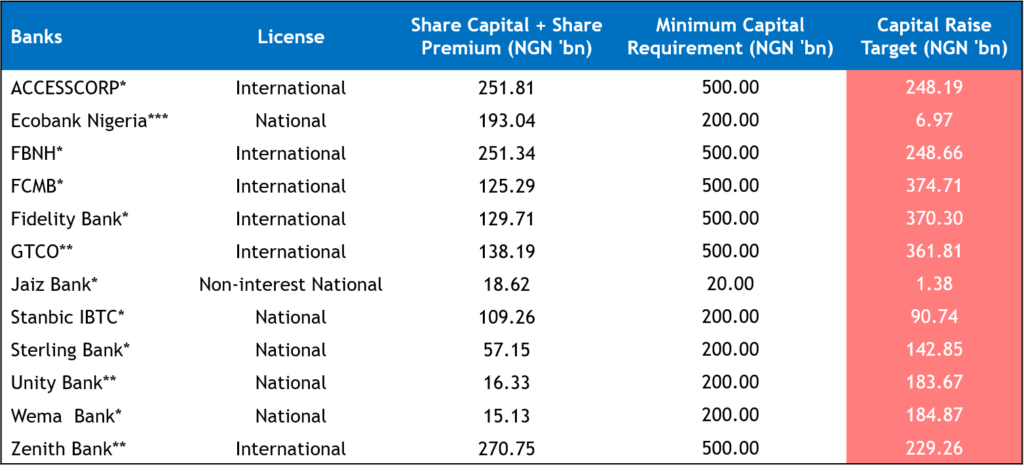

Nigerian banks have a relatively low assets-to-GDP ratio compared to global averages. While nominal Naira growth may mask this, the 2024 plan addresses the true capital needs in today’s economic climate, with an expected NGN3.6trn injection significantly exceeding the 2005 figure (adjusted for currency devaluation). To meet these requirements, banks have options: raising fresh capital, pursuing mergers and acquisitions for faster compliance (though with job loss risks), or adjusting their license tiers.

The Upsides of Recapitalization

On the positive side, the influx of fresh capital acts as a fortress, bolstering the banking system’s ability to weather economic storms. Higher capital buffers translate to a greater capacity to absorb losses and navigate potential financial shocks. This newfound strength can also act as a magnet, attracting foreign investors. Increased foreign participation injects valuable capital into the Nigerian economy, boosting external reserves and fueling long-term growth. Additionally, the capital raising exercise itself is expected to energize the domestic capital market. As banks tap into various channels to meet requirements, activity will surge, potentially benefitting market operators and fostering broader investor participation. A more robust financial system can also contribute to a more stable exchange rate which is positive for businesses and the overall economy.

The Other Side of the Coin: Challenges and Potential Risks

However, the path to recapitalization is not without its challenges. The most immediate concern for banks is devising effective strategies to raise the required capital within the stipulated timeframe. This may involve a combination of approaches, such as rights offerings, private placements, or even mergers and acquisitions. While some strategies offer quicker paths to compliance, they may come at the cost of job losses or a dilution of ownership for existing shareholders. This dilution can lead to a decrease in Return on Equity (ROE) in the short term, as profits are spread across a larger shareholder base. Additionally, the significant increase in capital within the banking system has the potential to lead to a long-term rise in money supply. Careful management by the CBN will be crucial to mitigate any potential inflationary pressures arising from this expansion.

We expect that banks will explore the capital raising options available to them in order to ensure compliance with the CBN’s directive while safeguarding long-term profitability.