The Senate approved a 2023 supplementary budget of NGN2.17 trillion with a deficit of NGN6.25 trillion

Global Macro Highlights

US Federal Reserve chose to keep the federal funds rate

The US Federal Reserve chose to keep the federal funds rate at 5.25%-5.5%, which remains its highest level in 22 years. During the previous month, the unemployment rate climbed to 3.9%, reaching its highest point since January 2022 and nonfarm payrolls saw an increase of 150,000 jobs, falling below pre-pandemic trends for the third time since December 2020. This decision to hold its rate, underscores the Federal Reserve’s dedication to tackling inflation while avoiding the exerting implications of excessive tightening of monetary policy.

BoE has decided to keep interest rates at 5.25%

The Bank of England (BoE) has decided to keep interest rates at 5.25%. This decision reflects the BoE’s dedication to addressing high inflation and its hesitancy to pursue additional rate hikes at this point. Furthermore, the BoE believes that the economy has only encountered half of the consequences of the recent rate increases, with the potential for more pronounced effects on household demand and overall economic activity.

ECB put an end to its series of 10 consecutive interest rate hikes

In its recent meeting, the European Central Bank (ECB) put an end to its series of 10 consecutive interest rate hikes, maintaining its key rate at 4.0%. This decision comes as the euro zone grapples with a declining inflation rate and a contracting economy, highlighting the consequences of the ECB’s assertive tightening measures. Notably, the euro zone’s economy shrank by 0.1% in the third quarter, a concerning development that raises the specter of a looming recession

Japan’s government announced the injection of over 17 trillion yen

Japan’s government announced the injection of over 17 trillion yen (USD113bn), to alleviate the economic repercussions of inflation. The government’s outlook is that these measures will have a favourable effect on Japan’s Gross Domestic Product (GDP), with an estimated average growth of 1.2% anticipated over the next three years. However, the need for additional spending might lead to increased government bond issuances, further contributing to Japan’s substantial public debt, which is currently twice the size of its economy and ranks as the largest among major economies.

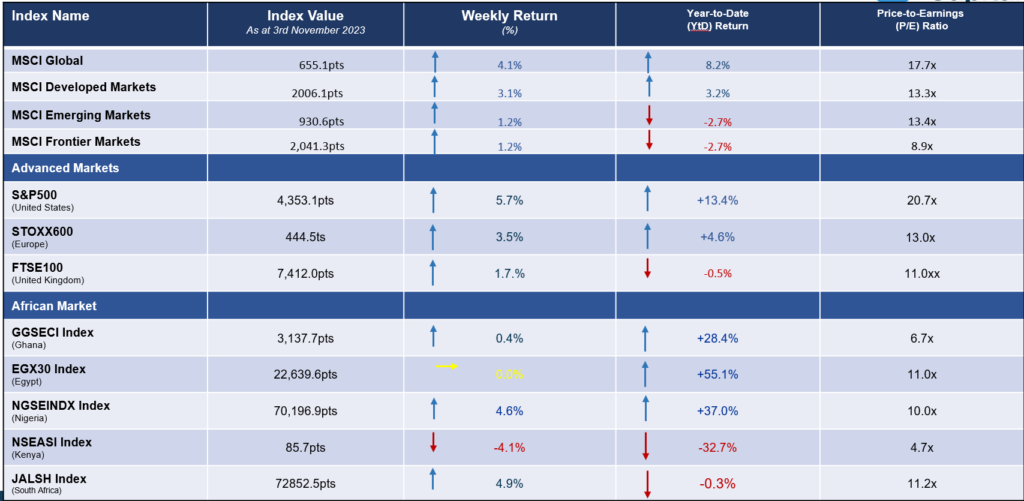

Global Equities Market

Weekly Performance of Major Global Indices

Domestic Updates

CBN has initiated proactive measures to address pending FX forward contracts

The Central Bank of Nigeria (CBN) has initiated proactive measures to address pending foreign exchange (FX) forward contracts. The CBN commenced the distribution of funds to different banks and airlines, successfully eliminating the backlog of unresolved contracts. This proactive approach is likely to have a positive impact by instilling greater confidence in the nation’s economic stability and currency management.

The reclassification of the MSCI Nigeria Indexes in a single step from Frontier Markets to Standalone Markets status

The Senate has given its approval to a supplementary budget of NGN2.17 trillion for the year 2023, which carries a deficit of NGN6.25 trillion, equivalent to approximately 3.39% of Nigeria’s GDP. Within this supplementary budget, a notable allocation of NGN605 billion has been set aside to strengthen national security and defense initiatives. This budget is anticipated to play a crucial role in addressing the nation’s prevailing security challenges and is expected to contribute to stimulating economic growth in Nigeria.

STANBIC has officially re-registered its subsidiary

Stanbic IBTC Holdings Plc (STANBIC) has officially re-registered its subsidiary, Stanbic IBTC Bank, as a private limited company, effective October 31, 2023. Notably, this transition maintains the bank’s status as a wholly owned subsidiary of STANBIC, with no changes in ownership, shareholding structure, or core business objectives.

GSK Consumer Nigeria announced that it has received approval from the SEC

GlaxoSmithKline Consumer Nigeria Plc (GSK Consumer Nigeria) announced that it has received approval from the Securities & Exchange Commission (SEC) to propose a Scheme of Arrangement for the dissolution of its business. The scheme will involve the cancellation of all outstanding shares.

CBN conducted two Open Market Operations (OMO)

Last week, the CBN conducted two Open Market Operations (OMO) auctions on October 30 and November 1. During these auctions, the average stop rate increased substantially, reaching 15.36%. It’s noteworthy that there was a significant decline in subscription levels, dropping from NGN632.75 billion in the Monday auction to NGN128.95 billion on Wednesday.

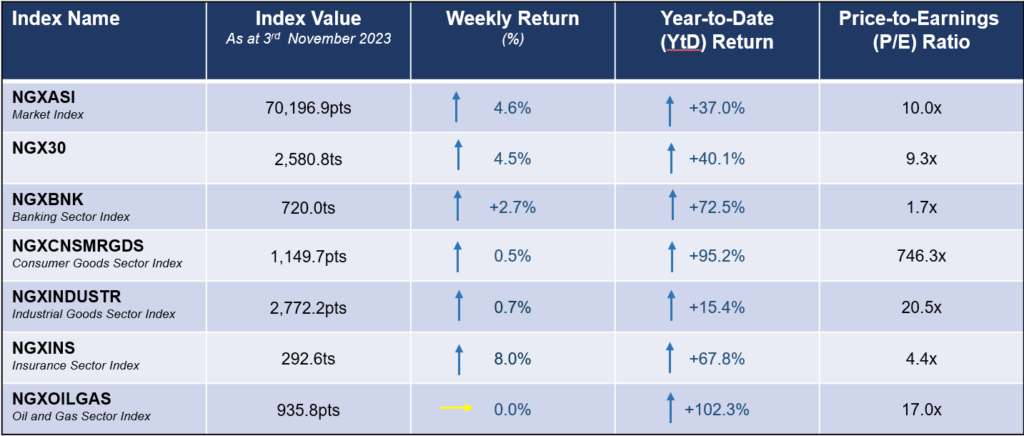

Equities Market – Sectorial Performance

Summary of Equities Transactions

Stock Picks for the week

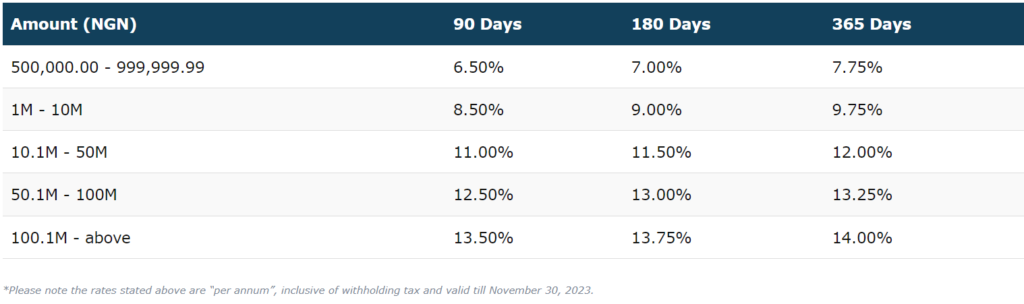

Utica Fixed Deposit Investment