The Federal Government has distributed over 2,700 trucks of fertilizers

Global Macro Highlights

U.S. Bureau of Labor Statistics reported that the country’s inflation rate decreased

The U.S. Bureau of Labor Statistics reported that the country’s inflation rate decreased to 3.0% YoY in June 2024, from 3.3% YoY in May 2024, This decline is attributed to lower energy prices (-3.80% YoY). Also, following the recent moderation in the labor market (additional jobs in June declined by 24.3% MoM), we expect U.S. inflation to continue its downward trend, potentially increasing the likelihood of a rate cut by the Federal Reserve.

China’s inflation rate decreased to 0.20% YoY in June 2024

In the Asian region, China’s inflation rate decreased to 0.20% YoY in June 2024 (vs 0.30% YoY in May 2024). This decline, following an unchanged rate in May, can be attributed to improved food supply, with food prices dropping by 2.1% YoY. Given that domestic demand in China remains weak amidst supply disruptions, we anticipate this downward trend to continue in the near term.

Ghana’s inflation rate eased for the third consecutive month to 22.8% YoY

In Sub-Saharan Africa, Ghana’s inflation rate eased for the third consecutive month to 22.8% YoY (from 23.1% YoY in May 2024). This decrease is attributed to a reduction in non-food prices (-8.5% YoY). Looking ahead, we anticipate that Ghana’s inflation will continue its downward trend, hinged on continued moderation in prices.

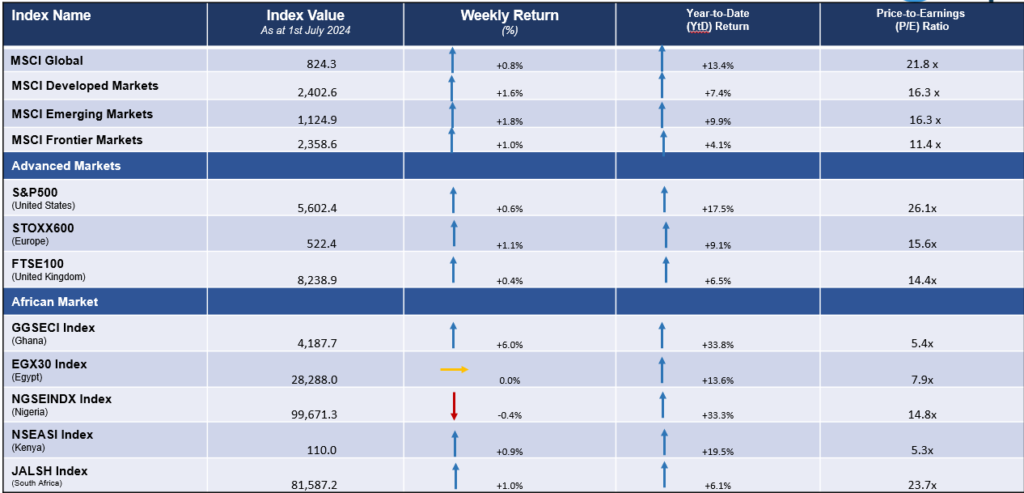

Global Equities Market

Weekly Performance of Major Global Indices

Domestic Updates

OPEC reported that Nigeria’s crude oil production increased by 1.6% to 1.3mpd in June

The Organisation of Petroleum Exporting Countries (OPEC) reported that Nigeria’s crude oil production increased by 1.6% to 1.3mpd in June (vs. 1.3% recorded in May). However, NNPC stated that Nigeria has the capacity to produce up to 2.0mbpd but experiencing short-fall due to the ongoing challenges of oil theft and pipe-line vandalism, which has significantly impacted oil output. Seeing government continuous effort in improving crude oil production, we anticipate a better output in the latter part of the year.

The Federal Government has distributed over 2,700 trucks of fertilizers

In a bid to address food crises in Nigeria and mitigate the impact of high fertilizer prices on farmers, the Federal Government has distributed over 2,700 trucks of fertilizers to various states, with each states receiving 60 trucks. Additionally, the government has also approved a 150-day duty-free window for the importation of maize, rice, and wheat. We believe these moves will reduce the cost of agricultural produce, and ultimately improve output and supply of food in the economy.

The Ministry of Power has signed a NGN115.2bn (USD75.0mn) MoU

In another development, the Ministry of Power has signed a NGN115.2bn (USD75.0mn) Memorandum of Understanding (MoU) with the United States Agency for International Development (USAID), to support electricity sector reforms. We believe this investment will enhance liquidity and productivity, and finally expand access to affordable power.

The Nigerian Exchange Limited (NGX) has launched the NGX Impact Board

The Nigerian Exchange Limited (NGX) has launched the NGX Impact Board, a platform for listing sustainability instruments. This aims to promote sustainable finance solutions through the listing of instruments such as green bonds, social bonds, and other related instruments. We believe this action will help create a broad ecosystem for responsible investing, improve liquidity on NGX and also increase general participation in the equities market.

At the T-Bills PMA, the CBN offered a total of NGN166.1bn

At the T-Bills PMA, the CBN offered a total of NGN166.1bn (vs NGN228.7bn at the previous auction) which attracted a lower subscription of NGN308.7bn (vs NGN774.0bn at the previous auction), ultimately, a total of NGN207.3bn was alloted (vs NGN284.3bn at the previous auction), While the stop rates for the 91-Day and 182-Day instruments was constant at 16.30%, and 17.44%, the rate on the 364-Day instrument increased to 21.2% (vs.20.7% recorded at the previous auction)..

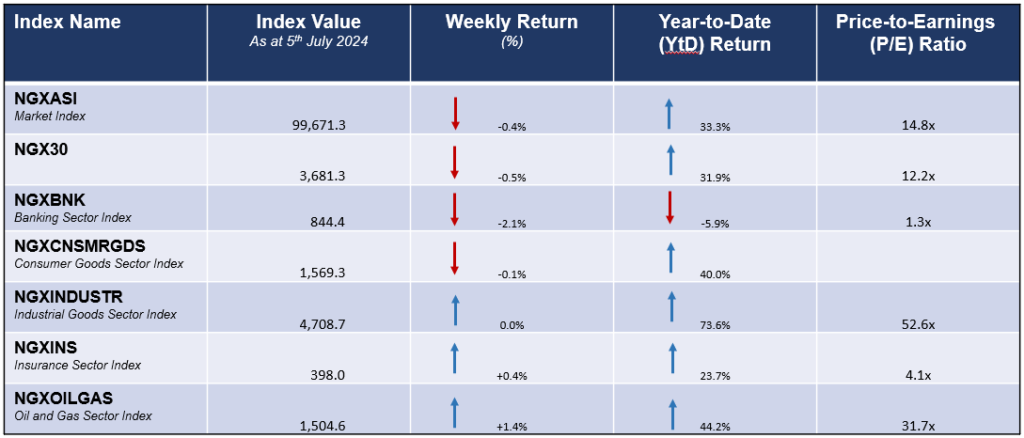

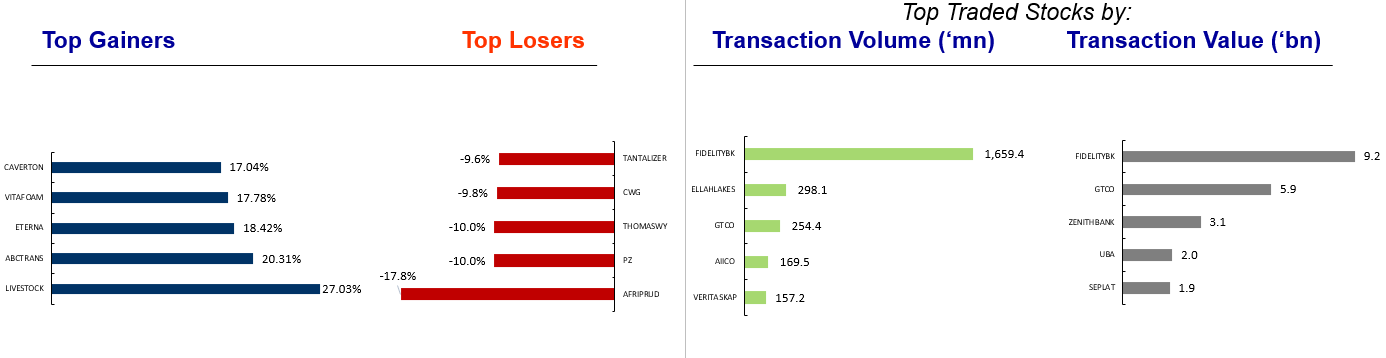

Equities Market – Sectorial Performance

Summary of Equities Transactions

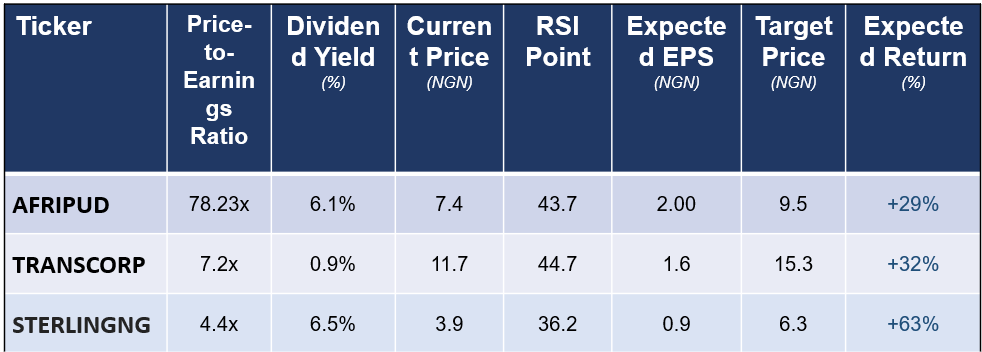

Stock Picks for the week

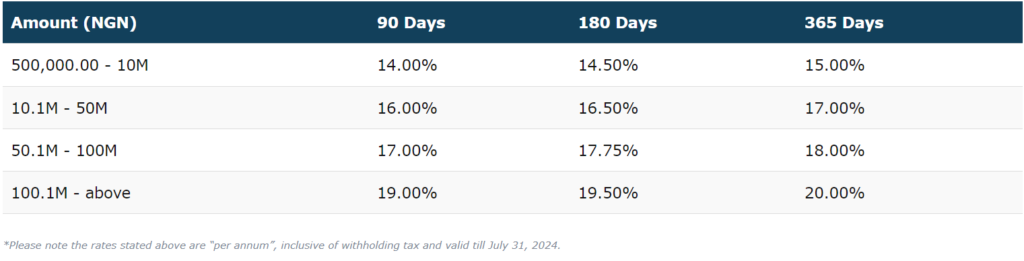

Utica Fixed Deposit Investment