Nigeria Deposit Insurance Corporation (NDIC) has declared a significant raise in the maximum insurance coverage.

Global Macro Highlights

the US non-farm payrolls increased at a slower pace by 175,000 jobs in April 2024

The U.S. Bureau of Labor Statistics reported that the US non-farm payrolls increased at a slower pace by 175,000 jobs in April 2024 (vs 315,000 in March 2024). This slowdown could be attributed to a sharp decline in hiring across construction 9000(vs 40,000 in March), leisure 5000(from 53,000) and the public sectors 8,000 (vs 72,000 in March). This signals a significant ease in the labor market trends and we expect this to offset the country’s inflationary pressures overtime. However, a suggestion of a likely rate cut might be taken into consideration in its next monetary policy meeting.

European Statistics Agency reported that the Eurozone economy grew by 0.3% QoQ in Q1:2024

Recent data from the European Statistics Agency reported that the Eurozone economy grew by 0.3% QoQ in Q1:2024 (vs -0.1% recorded in Q4:2023).This growth could be attributed to the expansion among the currency bloc’s largest economy including Germany’s relief to growth by 0.2%, Italy’s growth of 0.3% and Spain’s expansion of 0.7%. Looking forward, while the ECB had decided to keep rate constant at 4.5% since September 2023 to maintain an inflation target of 2.0%, we still expect ECB to further keep rates constant in near time giving its stance in its previous meeting to keep rates steady till its economy sustain balance and the risk of inflation uptick diminishes.

U.S Federal Reserve held its interest rates constant at 5.3%-5.5% for the 6th consecutive time

The U.S Federal Reserve held its interest rates constant at 5.3%-5.5% for the 6th consecutive time since July 2023 at its last monetary policy meeting, due to the increasing inflationary pressure in the economy in the first 3 months of the year to stand at 3.5% in March 2024. Going forward, we expect the committee to further keep rates constant as the country’s inflation is still way above its 2.0% target while putting under control other threats to price stability such as labor market trends and supply chain disrupt.

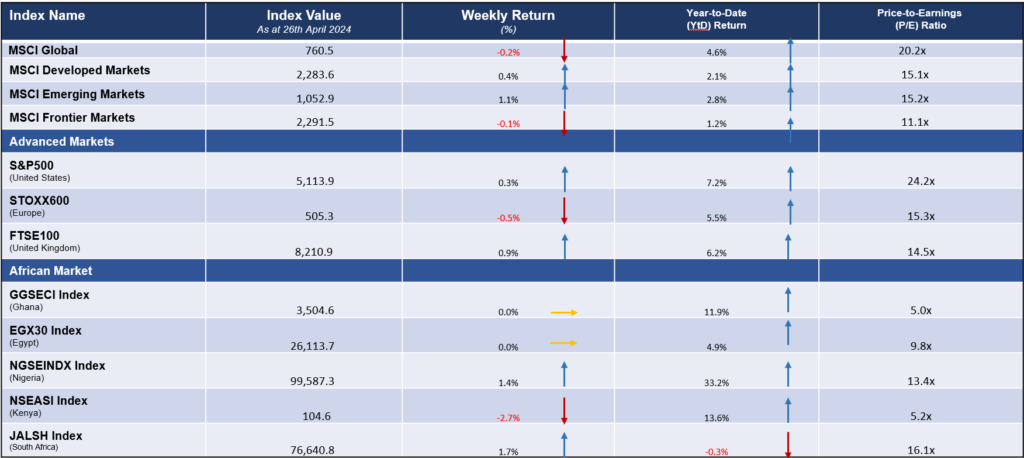

Global Equities Market

Weekly Performance of Major Global Indices

Domestic Updates

Federal government implemented a substantial boost in salaries for civil servants

The federal government implemented a substantial boost in salaries for civil servants, ranging from 25% to 35%, and has also greenlit a pension raise range of 20% to 28% to take effect on the 1st of May 2024. This decision is geared towards easing financial strains and elevating the living standards of civil servants and retirees across the country. Going forward, we expect this action to further improve individual purchasing power and consumer spending following the consumer credit scheme that was recently launched.

Nigeria Deposit Insurance Corporation (NDIC) has declared a significant raise in the maximum insurance coverage.

The Nigeria Deposit Insurance Corporation (NDIC) has declared a significant raise in the maximum insurance coverage for deposits across different banking sectors including The Deposit Money Banks (DMBs) NGN5.0mn (vs NGN500,000 previously), Microfinance Banks (MFBs) NGN2.0mn(vs NGN200,000), Primary Mortgage Banks (PMBs) NGN2.0m (vs NGN500,000) and Mobile Money Operators (MMOs) NGN5.0mn. This substantial increment is aimed at creating strategic balance between protecting depositors and ensuring the stability of the financial system. Looking ahead, we believe that this revised coverage will enhance investors confidence on the banking sector, hereby lowering the fear of risk. However, putting pressure on the banks’ regulatory cost.

The IMF presented a nuanced outlook for Nigeria, with the growth forecast for 2024 experiencing a modest increase to 3.3% from the previous estimate of 3.0%

The International Monetary Fund (IMF) presented a nuanced outlook for Nigeria, with the growth forecast for 2024 experiencing a modest increase to 3.3% from the previous estimate of 3.0%. However, the forecast for 2025 declined to 3.0%, down from 3.1%. These adjustments were made to align with the current macroeconomic conditions prevailing in the country.

Zenith Bank Plc shareholders have approved its restructuring to a holding company

Zenith Bank Plc shareholders have approved its restructuring to a holding company, through an act of delisting the initial shares on Zenith Bank Plc from the Nigerian stock exchange market (NGX) and transferring them to the holding company after re-registering. This decision aim at unlocking opportunities beyond banking for shareholders and It is expected that this move will boost investor’s confidence and enhance the company’s flexibility to diversify investments.

A government bond primary auction was conducted, offering NGN450 billion

In line with the bank recapitalization requirements of NGN500bn as directed by the Central bank of Nigeria, FCMB Group Plc also seek shareholder’s approval to raise a capital of NGN150bn through issuance of different securities including ordinary shares, preference shares, convertible or non-convertible notes, bonds, and other instruments. This move not only addresses the immediate need for recapitalization but also sends a positive signal to investors about the company’s commitment to financial stability and compliance with regulatory standards. We believe that this move might further reduce investor’s pessimism towards the company’s stock and to the banking sector at large.

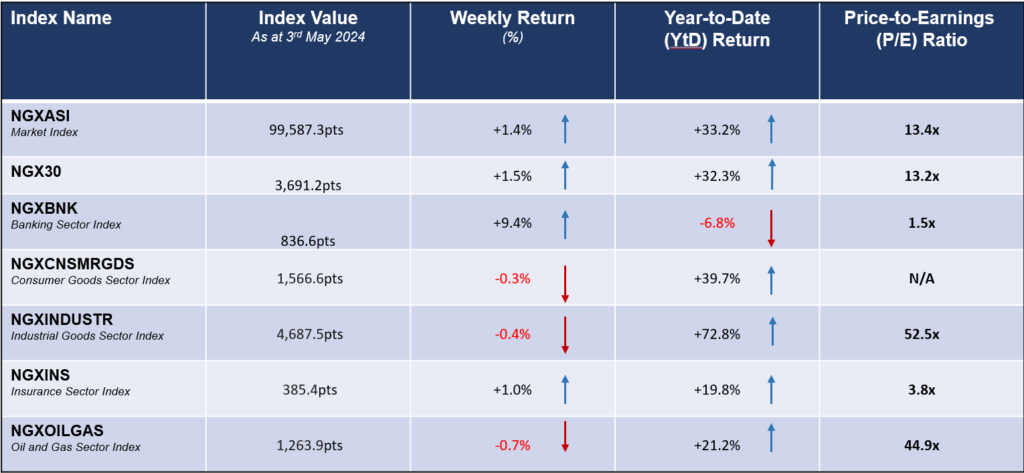

Equities Market – Sectorial Performance

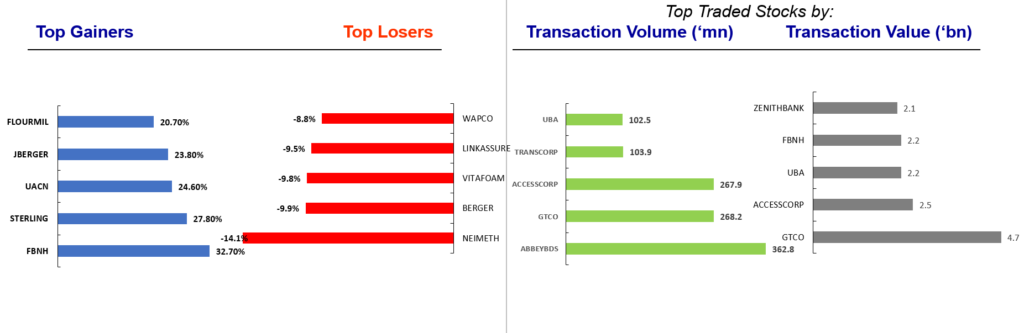

Summary of Equities Transactions

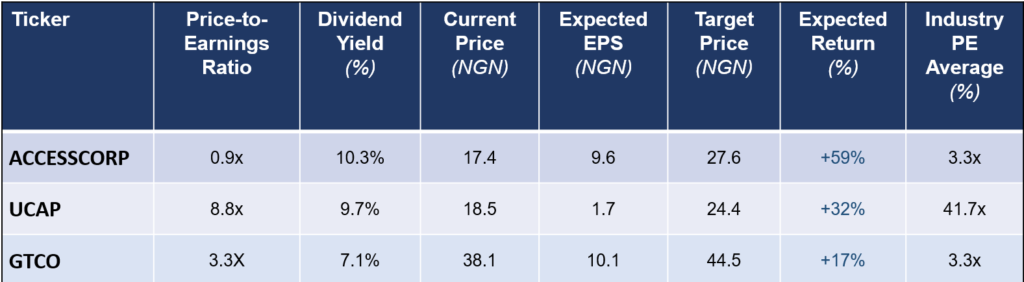

Stock Picks for the week

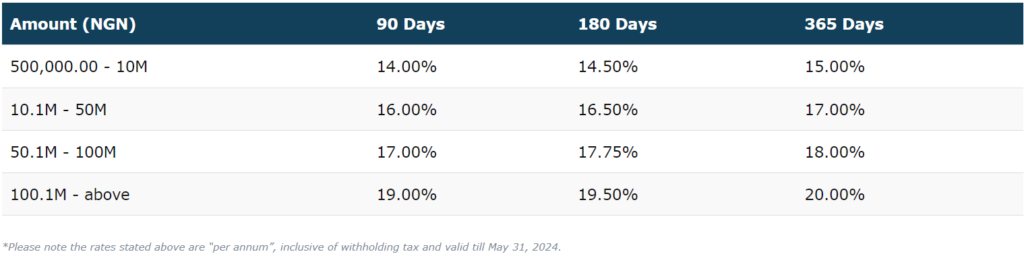

Utica Fixed Deposit Investment