NERC has instructed the grid operator to reduce electricity supplies to international customers

Global Macro Highlights

The Bank of England opted to hold its interest rate steady at 5.3%

At its recent meeting, the Bank of England opted to hold its interest rate steady at 5.3% for the sixth consecutive meeting. The Monetary Policy Committee highlighted key indicators, noting a 6.0% services inflation rate recorded in March. Looking forward, we expect the central bank to closely monitor forthcoming macroeconomic data to assess the ongoing inflationary pressures as will guide the decisions at its next policy meeting in June.

Ghana’s inflation rate declined to 25.0% YoY in April 2024 from 25.8% in March

In Sub-Saharan Africa, the Ghana Statistical Service (GSS) reports that Ghana’s inflation rate declined to 25.0% YoY in April 2024 from 25.8% in March. This decrease is attributed primarily to a decline in food prices as food inflation plunged to 26.8% from 29.6% in March. We anticipate a contractionary monetary policy stance from the Bank of Ghana, given that inflation still surpasses the bank’s target range of 6.0 to 10.0%.

China’s exports and imports rebounded in April 2024

In Asia, China’s exports and imports rebounded in April 2024, growing by 1.5% and 8.4% in April respectively (vs. -7.5% and 1.9% in March). This rebound can be attributed to deflationary pressures stemming from weak domestic demand, which enhanced the global competitiveness of Chinese goods, and government stimulus packages, which boosted domestic demand and subsequently improved import levels. With stimulus measures likely to continue, we anticipate a sustained growth in both domestic and foreign demand going forward.

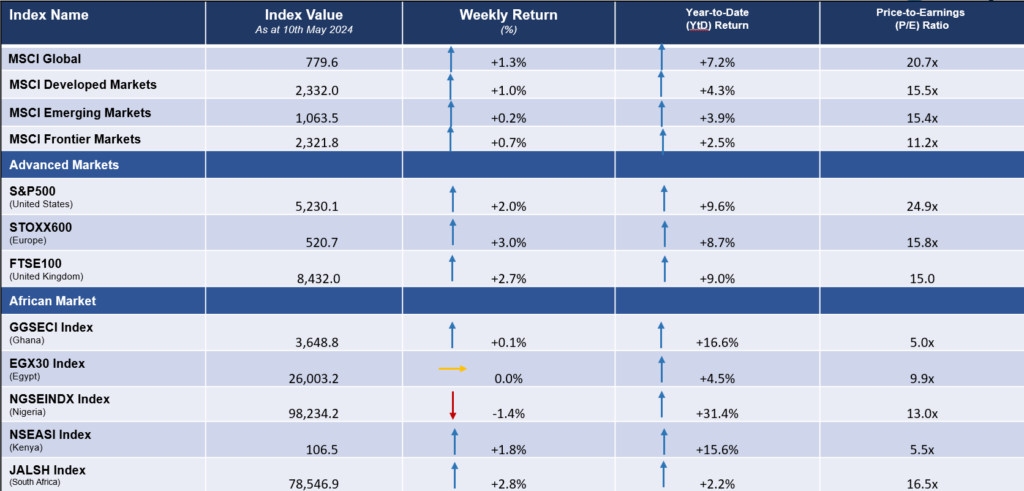

Global Equities Market

Weekly Performance of Major Global Indices

Domestic Updates

CBN has mandated banks and financial institutions to apply a 0.50% cybersecurity levy on all electronic transactions

The Central Bank of Nigeria (CBN) has mandated banks and financial institutions to apply a 0.50% cybersecurity levy on all electronic transactions, effective two weeks after the issuance of the directive. This levy is directed towards the National Cybersecurity Fund, overseen by the Office of the National Security Adviser, aligning with the 2024 Cybercrime (Prohibition, Prevention, etc.) Amendment Act. The introduction of this levy serves the purpose of financing national cybersecurity efforts, aimed at bolstering security measures within the financial sector. The funds raised will support initiatives targeting cyber threats, ultimately enhancing online security for both institutions and customers.

NERC has instructed the grid operator to reduce electricity supplies to international customers.

The Nigerian Electricity Regulatory Commission (NERC) has instructed the grid operator to reduce electricity supplies to international customers to enhance domestic supply within Nigeria. This directive was in response to concerns that the grid operator’s current strategy prioritizes supplying energy to international customers under bilateral contracts, leading to considerable challenges for Nigerian consumers. We believe that this would reduce the gap between demand and supply. However, this will reduce international revenue streams.

CBN reported a significant 39.7% increase in Nigeria’s external debt service to USD1.12 billion in Q1:2024

The Central Bank of Nigeria (CBN) reported a significant 39.7% increase in Nigeria’s external debt service to USD1.12 billion in Q1:2024 from USD801.4 million in the same period last year. This surge was driven by higher borrowing costs due to elevated global interest rates and the continuous depreciation of the Naira. The report indicated that c.70% of dollar outflows were utilized for servicing external debt during this period. As the Naira’s depreciation persists, we anticipate that the government’s debt service obligations will further rise, posing challenges to fiscal sustainability.

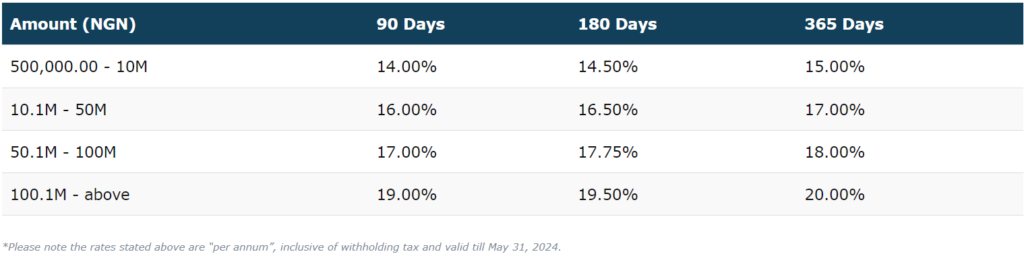

OMO auction held this week, total amount offered stood at NGN500bn

At the OMO auction held this week, total amount offered stood at NGN500bn, while total amount subscribed is NGN291.6bn. Stop rate increased across the 91-day, 180-day and 364-day instruments increased to 19.0%, 19.5%, and 21.5% respectively, (vs. 16.2%, 17.0%, and 20.7% recorded in the last OMO auction). Also, at the T-bills market, a total of NGN179.4bn was offered (vs. NGN142.6bn at the last auction). Total subscription declined to NGN914.1bn (vs. NGN1.5trn at the previous auction), while the amount allotted was NGN274.7bn (vs. NGN362.45bn at the previous auction). Subsequently, stop rates across the 91-day, 180-day and 364-day instruments remained steady at 16.2%, 17.0%, and 20.7%, respectively.

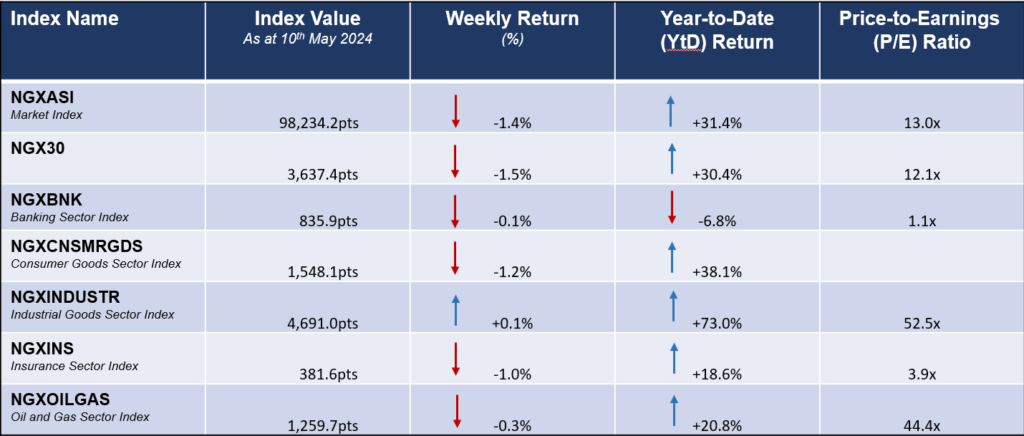

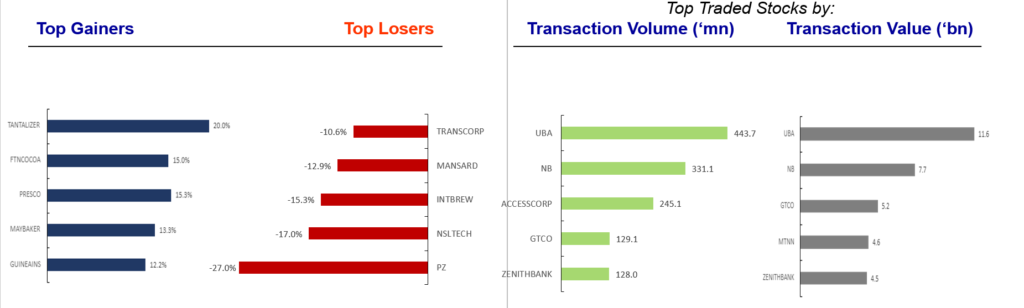

Equities Market – Sectorial Performance

Summary of Equities Transactions

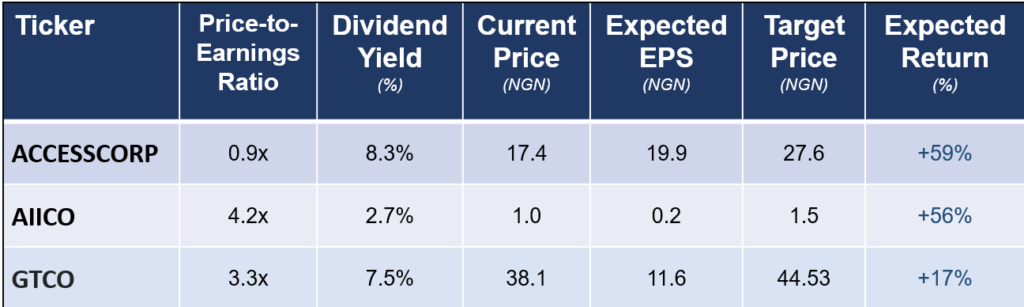

Stock Picks for the week

Utica Fixed Deposit Investment